Quick search

CTRL+K

Quick search

CTRL+K

Since 2010, the Global Law Experts annual awards have been celebrating excellence, innovation and performance across the legal communities from around the world.

posted 3 years ago

Cryptocurrency is referred to a wide array of technological developments that utilize a technique better known as cryptography. In simple terms, cryptography is the technique of protecting information by transforming it (i.e. encrypting it) into an unreadable format that can only be deciphered (or decrypted) by someone who possesses a secret key. Cryptocurrency is secured via this technique using an ingenious system of public and private digital keys. However, no generally accepted definition has been agreed so far.

In particular, the World Bank has classified cryptocurrencies as a subset of digital currencies, which is defined as digital representations of value that are denominated in their own unit of account, distinct from e-money, which is a simple digital payment mechanism, representing and denominated in fiat money.

Meanwhile, the European Banking Authority has suggested to refer to cryptocurrencies as virtual currencies, which it defines as digital representations of value that are neither issued by a central bank or public authority, nor necessarily to a fiat currency, but are used by natural or legal persons as a means of exchange and can be transferred, stored or traded electronically[1].

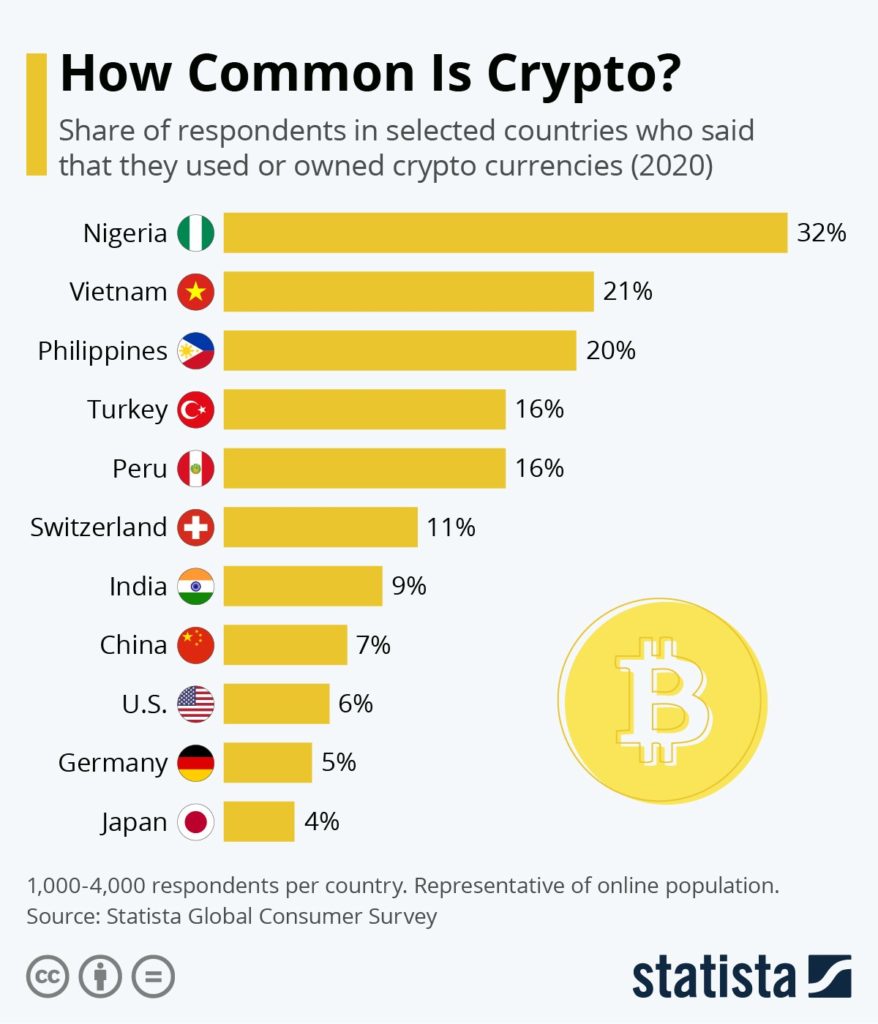

There is no definition of cryptocurrency under the laws of Vietnam. Nevertheless, cryptocurrency has proved popular in Vietnam, after a report on survey results released by Statista, a global provider of market and consumer data, says that 21% of respondents in Vietnam said they used or owned cryptocurrency in 2020, second after Nigeria (32%).

However, there are some restrictions with regards to cryptocurrency in Vietnam, most notably, its regulations.

Is cryptocurrency considered as legal property or payment instrument in Vietnam?

Under the laws of Vietnam, cryptocurrency is neither legal property nor payment instruments.

Particularly, under Article 105 of the Civil Code 2015, property is defined as below:

Article 17 of the Law on the State Bank of Vietnam provides that “the State Bank of Vietnam is the sole agency entitled to issue banknotes and coins of the Socialist Republic of Vietnam. Banknotes and coins issued by the Stale Bank of Vietnam are lawful means of payment on the territory of the Socialist Republic of Vietnam”.

In addition, Article 1 Decree No. 80/2016/ND-CP, amending the Decree No. 101/2012/ND-CP, on non-cash payments provides that “Non-cash payment instruments in payment transactions (hereinafter referred to as payment instruments), including cheques, payment orders, collection orders, bank cards and other payment instruments as prescribed by the State Bank of Vietnam. Illegal payment instruments are payment instruments not included in Clause 6 of this Article”.

In practice, the State Bank of Vietnam has not, so far, defined or named the so-called “other payment instruments”. Consequently, only cheques, payment orders, collection orders, bank cards or any other payment instruments, which are named or defined by the State Bank of Vietnam, are payment instruments. Since cryptocurrency has never been named or defined as the payment instrument by the State Bank of Vietnam, it is not considered as legal non-cash payment instrument.

Furthermore, on 21st July 2017, the State Bank of Vietnam reaffirmed its opinion on the legal status of cryptocurrency in Vietnam, when issuing the Dispatch No. 5747/NHNN-PC to the Government Office in response to a question about Bitcoin, Litecoin, and other virtual currencies. Particularly, the Dispatch said “As stipulated in Vietnam legislation, cryptocurrencies in general, or Bitcoin and Litecoin, in particular, are not currencies and do not act as lawful means of payment”.

Most recently, the State Bank of Vietnam issued a directive[2] requesting organizations issuing bank cards, intermediary payment service providers, and representative offices of foreign banks to supervise, inspect and check card transactions arising at merchants in order to prevent, among others, card transactions that are not in accordance with the provisions of the laws (relating to prize-winning games, gambling, betting, foreign exchange business, securities, virtual or digital currency…).

What are the risks associated with cryptocurrency trading in Vietnam?

Currently, the Government of Vietnam has not yet issued license to any organization wishing to do cryptocurrency business in Vietnam.

In a press conference on monetary policy and banking operations in the first quarter of 2019. Mr. Nghiem Thanh Son, Deputy Director of Payment Department of the State Bank of Vietnam, verbally affirmed that the State Bank of Vietnam has not yet issued any license to any company wishing to do cryptocurrency business in Vietnam.

Running cryptocurrency business has been excluded by Vietnam in the Schedule of WTO Commitments, and in the absence of Vietnamese legislation on this kind of business, any investor wishing to do cryptocurrency business in Vietnam is requested to consult with and obtain the approval from various competent authorities in Vietnam, including Ministry of Planning and Investment, the Ministry of Finance, the State Bank of Vietnam; and other relevant Ministry (if any) in accordance with clause dd, Article 10, Decree 118/2015/ND-CP.

Doing cryptocurrency business in Vietnam without license shall be subject to administrative sanctions in accordance with the laws of Vietnam. Specifically, any investor doing cryptocurrency business in Vietnam without license shall be subject to an administrative penalty of VND50,000,000 to VND100,000,000, and the foreign exchange operations of the credit institution shall be suspended for three to six months.

In addition, according to point h, Clause 1, Article 206, Criminal Code 2015 (amended and supplemented by Criminal Code 2017) on the offense against regulations of law on banking operations and banking-related activities, from 1st January 2018, anyone who commits acts including issuing, supplying or using payment instruments causing damage to other people (including enterprises) from VND100,000,000 to VND300,000,000 shall be fined from VND50,000,000 to VND300,000,000 or imprisoned for six months to three years.

Any future for cryptocurrency in Vietnam?

Cryptocurrency is revolutionizing the global payment industry, by allowing online payments to be sent directly from one party to another without going through a financial institution serving as trusted third party to process electronic payments. Backed by an electronic payment system based on cryptographic proof instead of trust, it avoids inherent weaknesses of the trust-based model.

However, Vietnam seems to take very cautious steps towards cryptocurrency, as cryptocurrency is alleged to have no government supervision and is therefore prone to illegal activities, such as tax evasion, money laundering, terrorist funding and hacking, and so cryptocurrency might possess the capacity to destabilize existing financial systems, which can affect the nation’s economy.

While cryptocurrency trading and use are booming globally in terms of popularity, Vietnam cannot stand outside the game, and one of the most recent actions in response to cryptocurrency is that the Ministry of Finance established a research group on March 30, 2021, led by Mr. Pham Hong Son, Vice-Chairman of State Securities Commission, to conduct an in-depth study of cryptocurrency, with a view to achieving legislative reform for the industry in the country.

In practice, the current transition of Vietnam’s economy offers a particularly favorable context for cryptocurrency, when non-cash payment has been used increasingly with many apps, QR codes, and e-wallets such as Moca, Momo or ZaloPay. The research on cryptocurrency seems to be backed by the Directive No. 22/CT-TTg dated May 26, 2020, figuring out measures to accelerate the implementation of a scheme on development of non-cash payment in Vietnam, after five years of implementing the Decision No. 2545/QD-TTg, dated 30 December, 2016, approving a scheme on development of non-cash payment for the period of 2016–2020, with an ambitious goal of slashing the ratio of cash to total payment instruments to below 10%.

Even with recent active responses by the Government of Vietnam, to the boom of cryptocurrency in Vietnam, the future of cryptocurrency is not secure and reliable in the country until regulatory frameworks are put in place.

2] Directive No. 02/CT-NHNN, dated 7 January, 2021, on enhancing the prevention of bank-card-related violations.

posted 58 mins ago

posted 13 hours ago

posted 13 hours ago

posted 3 days ago

posted 4 days ago

posted 4 days ago

posted 4 days ago

posted 4 days ago

posted 4 days ago

posted 7 days ago

There are no results matching your search.

ResetFind the right Legal Expert for your business

Sign up for the latest legal briefings and news within Global Law Experts’ community, as well as a whole host of features, editorial and conference updates direct to your email inbox.

Naturally you can unsubscribe at any time.

Global Law Experts is dedicated to providing exceptional legal services to clients around the world. With a vast network of highly skilled and experienced lawyers, we are committed to delivering innovative and tailored solutions to meet the diverse needs of our clients in various jurisdictions.